Water damage is one of the most common and costly issues homeowners face. Whether caused by a burst pipe, heavy rainfall, or a malfunctioning appliance, water damage can lead to extensive repairs and significant expenses. This guide will help you understand the costs associated with fixing water damage, the restoration process, and how insurance can help cover these expenses.

What is Water Damage?

Water damage refers to the destruction caused by water intruding into a property. It can lead to structural damage, mold growth, and other health hazards if not addressed promptly. There are three main types of water damage:

- Clean Water Damage: Caused by clean water from sources like broken pipes or rainwater.

- Gray Water Damage: Involves slightly contaminated water from appliances like washing machines or dishwashers.

- Black Water Damage: The most severe type, caused by highly contaminated water from sewage or flooding.

Common causes of water damage include leaking roofs, burst pipes, faulty appliances, and natural disasters. Understanding the type and source of water damage is crucial for determining the appropriate restoration approach.

Average Costs of Water Damage Restoration

The cost to fix water damage varies widely depending on several factors. On average, homeowners can expect to pay between $1,200 and $5,000 for water damage restoration. However, costs can escalate for severe cases involving black water or extensive structural damage.

Factors Influencing Costs:

- Size of the Affected Area: Larger areas require more time, labor, and materials, increasing the overall cost.

- Type of Water: Clean water damage is less expensive to fix than gray or black water damage, which requires specialized cleaning and safety measures.

- Severity of Damage: Minor leaks may only need drying and minor repairs, while severe damage may involve replacing drywall, flooring, and insulation.

For example, repairing a small section of drywall might cost around $500, while restoring a flooded basement could exceed $10,000. It’s essential to get a professional assessment to understand the scope and cost of the damage.

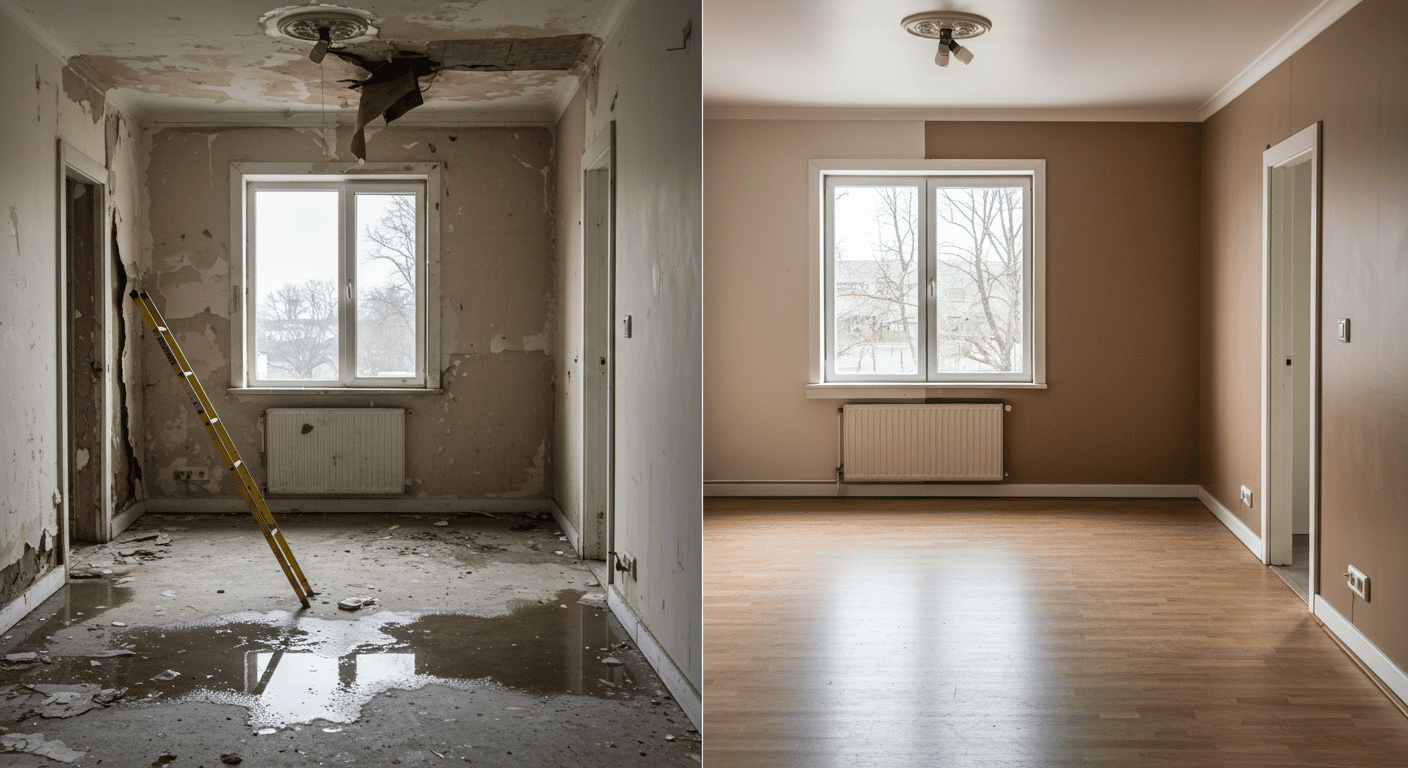

The Restoration Process Explained

Water damage restoration involves several steps to ensure your home is safe and habitable again. Here’s a step-by-step overview of the process:

- Assessment and Inspection: Professionals evaluate the extent of the damage and identify the type of water involved.

- Water Removal: Using pumps and vacuums, they remove standing water to prevent further damage.

- Drying and Dehumidification: Industrial-grade dehumidifiers and air movers are used to dry the affected areas thoroughly.

- Cleaning and Sanitizing: Surfaces are cleaned and disinfected to prevent mold growth and eliminate contaminants.

- Repairs and Restoration: Damaged materials like drywall, flooring, and insulation are repaired or replaced.

While some minor water damage can be addressed with DIY methods, professional help is often necessary for severe cases. Experts have the tools and expertise to handle the situation effectively, ensuring your home is restored to its original condition.

Insurance and Water Damage: What You Need to Know

Homeowners insurance can be a lifesaver when dealing with water damage, but coverage depends on the cause of the damage. Most policies cover sudden and accidental water damage, such as a burst pipe, but exclude damage caused by neglect or flooding.

Tips for Navigating Insurance Claims:

- Document the Damage: Take photos and videos of the affected areas before starting repairs.

- Contact Your Insurance Provider: Notify your insurer as soon as possible to initiate the claims process.

- Understand Your Policy: Review your policy to know what is covered and what isn’t.

- Hire a Public Adjuster: If needed, a public adjuster can help you negotiate with your insurance company for a fair settlement.

For flood-related damage, you’ll need separate flood insurance, as standard homeowners insurance doesn’t cover this. Being proactive and understanding your coverage can save you time and money in the long run.

For more insights on water damage and its implications, check out our guide on black mold prevention and remediation.

Water damage can be a stressful and costly experience, but understanding the costs, restoration process, and insurance coverage can help you navigate the situation more effectively. Whether you’re dealing with a minor leak or a major flood, taking prompt action and seeking professional help is key to minimizing damage and expenses.